Need to complete your FinCEN report?

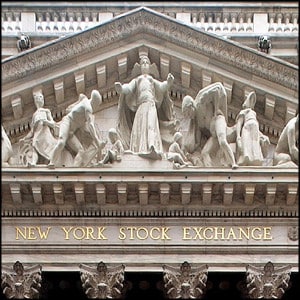

of timely access to appropriate capital markets. Although the capital needs of many concerns can adequately be met by standard banking sources, there often comes a time when the relative inflexibility of commercial banks makes such financing either unattractive, unfeasible or unavailable.

of timely access to appropriate capital markets. Although the capital needs of many concerns can adequately be met by standard banking sources, there often comes a time when the relative inflexibility of commercial banks makes such financing either unattractive, unfeasible or unavailable.

Once outside “normal” banking channels, the financial choices presented to businesses are awesomely complex and varied. Should a business finance with debt, equity, debt with an equity “sweetener” or convertible debt? Is the financing available through institutions, private investors or through a public securities offering? Will investment banking or brokerage assistance be available? If equity is used, what percentage of the company should be offered? Should the stock be common or preferred and, if the latter, how should the preferred be structured? What dividend policy is appropriate?

For more information concerning our debt & equity financing services, please contact us at 717-215-9703 or use the form on our Contact page.